Payroll tax penalty calculator

Interest is calculated by multiplying the unpaid tax owed by the current interest rate. Calculate pay or remove the Failure to File Penalty when you dont file your tax return by the due date.

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Words

5 of the amount due.

. Multiple steps are involved in the computation of Payroll Tax as enumerated below. COVID Penalty Relief To help taxpayers affected by the COVID. All Services Backed by Tax Guarantee.

Free Unbiased Reviews Top Picks. Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software.

After two months 5 of the. The IRS charges a penalty for various reasons including if you dont. The Failure to Pay Penalty is 05 of the unpaid taxes for.

The IRS charges a flat rate for payroll or FICA taxes. General Oregon payroll tax rate information. The maximum penalty is 25 of the additional taxes.

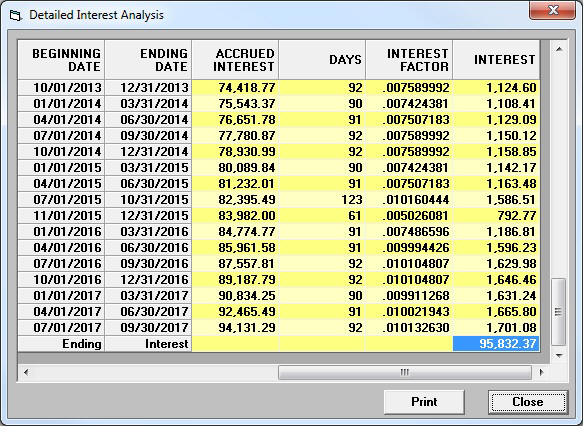

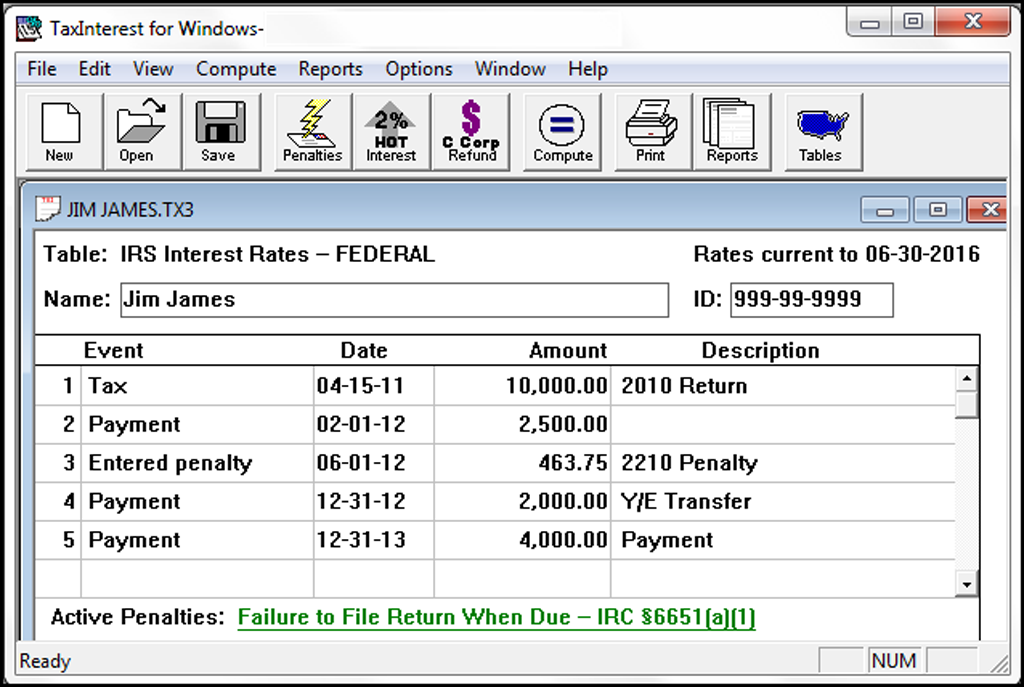

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related. The IRS interest and penalty calculator calculates the penalty amount on the basis of your filing status income quarterly tax amount and deduction method. Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year.

3 if the amount is one to three days late 5 if it is four or five days late 7 if it is six or seven days late 10 if it is more than seven days late or if no amount is remitted. PayrollPenalty calculates the lowest Failure To Deposit FTD penalty using IRS approved allocation methods IRC Code 6656 Rev. 2 of the amount due.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Taxpayers who dont meet their tax obligations may owe a penalty. How to Calculate Payroll Tax.

Discover ADP Payroll Benefits Insurance Time Talent HR More. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related. Additions to Tax and Interest.

The amount of the underpayment The period when the underpayment was due and underpaid The interest rate for underpayments that we. This deposit penalty calculator can be used for forms 941 944 940 945 720 with limits 1042 and form CT-1 to provide deposit penalty and interest calculations. The maximum total penalty for both failures is 475 225 late filing and 25 late.

If you dont pay the amount shown as tax you owe on your return we calculate the Failure to Pay Penalty in this way. The penalty for not doing your taxes is typically around 5 of the tax you owe increasing by 5 each month until reaching a maximum failure to file penalty of 25. Your payment is 16.

Your payment is 6 to 15 days late. By using this site you agree to the use of cookies. Get Started With ADP Payroll.

The penalty is only 025 on installment plans if a taxpayer filed the tax return on time and the taxpayer is an individual. File your tax return on time. Determine the cost of not paying up.

Ad Process Payroll Faster Easier With ADP Payroll. One notable exception is if the 15th falls on a. Thus the combined penalty is 5 45 late filing and 05 late payment per month.

Penalty is 5 of the total unpaid tax due for the first two months. Your payment is 1 to 5 days late. We calculate the penalty based on.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll. Its quick and easy.

Step 1 involves the employer obtaining the employers identification. Ad Compare This Years Top 5 Free Payroll Software. How We Calculate the Penalty We calculate the amount of the Failure to Deposit Penalty based on the number of calendar days your deposit is late starting from its.

Ad Process Payroll Faster Easier With ADP Payroll. By using this site you agree to the use of cookies. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

Employers deduct 62 of employee gross wages for Social Security until the wage base is reached and 145 for Medicare. If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty up to 25000. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

Filing Taxes Mistakes You Cannot Afford To Make Tax Relief Center Filing Taxes Tax Help Tax Mistakes

Failure To Deposit Penalty Calculator Tax Software Information

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Pin On Kreig Llc

Tax941 Irs Payroll Tax Interest And Penalty Software Timevalue Software

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Payroll Tax Penalties Small Businesses Should Know About Workest

Payroll Tax Penalties Small Businesses Should Know About Workest

Payroll Tax Penalties Small Businesses Should Know About Workest

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax